COVID-19 Short-Term Rental Data

Analyzing the Impact of COVID-19 on Vacation Rentals

COVID-19 Short-Term Rental Data: What Happened

The onset of the COVID-19 pandemic on international lodging was unlike any force in the industry’s history. As travel came to a virtual standstill for several months during spring and summer, short-term rental operators were forced to rethink strategies and draw up new game plans.

As outlined in our initial COVID-19 short-term data reports, COVID inundated hosts with cancellations. Bookings were significantly stifled, and many countries reported revenue declines of over 50% from January to March.

COVID-19 Vacation Rental Data Trends

As many markets around the world reported grim returns, that wasn’t the case for all destinations. In fact, some vacation rental locations actually saw a surge in new bookings amidst COVID-19.

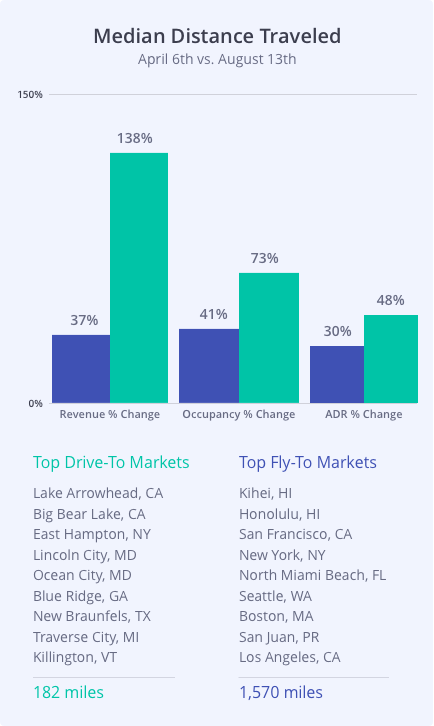

As early as late March, travel-hungry tourists began flocking to rural, drive-to getaways throughout the world. The average distance traveled plummeted, road trips made a quick resurrection, and non-urban short-term rentals began curiously benefiting. What’s more, these locations also saw less downfall in key metrics such as occupancy, ADR, RevPAR, and revenue.

Other major trends we saw were in regards to the dynamics of demand — not only were travelers changing where they booked, but also how they booked. The average length of stay for rentals during COVID skyrocketed by 58% while booking lead times shrunk significantly. Travelers were booking larger units in remote locations with limited notice and for long chunks of time.

Investing in Real Estate During COVID-19

COVID has also significantly shaken up the short-term investment landscape. Somewhat surprisingly, real estate has remained remarkably strong throughout the duration of the crisis.

That said, many of the locations that were profitable prior to 2020 are now struggling to stay afloat while others are seeing unprecedented demand. In order to make the smartest investment decision, leverage Rentalizer, AirDNA’s free Airbnb profit calculator that allows investors to gauge the value of a new acquisition and agents to advise on the income potential of second-home buyers.

Plus, dive into our latest report on the Best Places to Invest in U.S. Vacation Rentals in 2020.

Looking for deeper analysis? Large real estate investors rely on raw data to compare property performance data across markets. Downloadable, listing-level data allows investors to power their own analytics and identify new investment opportunities. Custom reports showcase top properties based on occupancy, ADR, and revenue with up to 6 years of historical data.

Coronavirus Data: Hotels or Short-Term Rentals?

In August of 2020, AirDNA conducted a joint report with STR on how Coronavirus has impacted the respective markets of hotels and short-term rentals. Some of the major findings? Vacation rentals are — not surprisingly — faring better than their hotel counterparts. Travelers prefer entire homes, full kitchens, and outdoor space to abide by social distancing protocols. Compared to hotels, short terms rentals saw higher Average Daily Rates in July 2020 than in July 2019 in many countries around the world.

Future-Looking COVID-19 Data: Adjusting to the New Normal

Although historical data is still an integral part of understanding demand, real-time forward-looking data will take your pricing and demand strategies to a whole new level. If you’re looking to see which day or week is seeing a spike in new bookings, or what rates are being booked, make sure to monitor MarketMinder’s “Pacing” feature to study daily real-time travel trends.

Be the first to see spikes in occupancy, rate increases, and booking windows up to 6 months in the future. This tool allows you to take your revenue management game to the next level and outsmart the competition.